Ten minutes later, every seat and the back of the car is loaded with water. I drive off, covering the five miles from the Circle K to my farm cautiously so that nothing spills. I enter the gate that the neighboring homeowner’s association has illegally installed on our property and I see that my husband is already up trimming a dragon fruit tree.

I load the water bottles into the single-wide trailer. In the kitchen, I pour one whole gallon into the aluminum stock pot labeled “water only”. I light a match and let the water boil. I run around grabbing clothes, shoes, and towels. When the water is boiled, I wake my six-year-old son, Pharaoh. I pour a quarter of the hot water and one whole gallon of cold water into the Rubbermaid container. He climbs in and sits, his eyelids still closed. I put the three year old, Phailani, on the toilet to do her morning business. I scrub Pharaoh’s tight curly hair and brown sugar skin. I use the bath water to flush the toilet. Then Robert Hayden whispers in my mind’s-ears, “Sundays too my father… got dressed in the blue black cold then with cracked hands…made banked fires blaze…”

The other two quarts of hot water is split between my sixteen year old, Phanesia, and me. After we’re washed and dressed and ready for church, I step outside. Reality slaps the poetry out of my mind as I stare at the empty shell of the 5,500 square foot house that once housed our dreams. It looks like a bomb hit it. Our 10 x 40 foot trailer sits about forty feet from the shell of our burnt dream home.

On December 14, 2013, our home burned down. This was our dream home on a little farm—realized through a lot of sacrifices, sweat and blood. For example, when our financing bank (IndyMac) was seized by the Federal government in 2008, we sold some of our assets to finish the house. We dreamed of creating an organic farm, but that dream is now deferred.

On December 14, 2013, our home burned down. This was our dream home on a little farm—realized through a lot of sacrifices, sweat and blood. For example, when our financing bank (IndyMac) was seized by the Federal government in 2008, we sold some of our assets to finish the house. We dreamed of creating an organic farm, but that dream is now deferred.

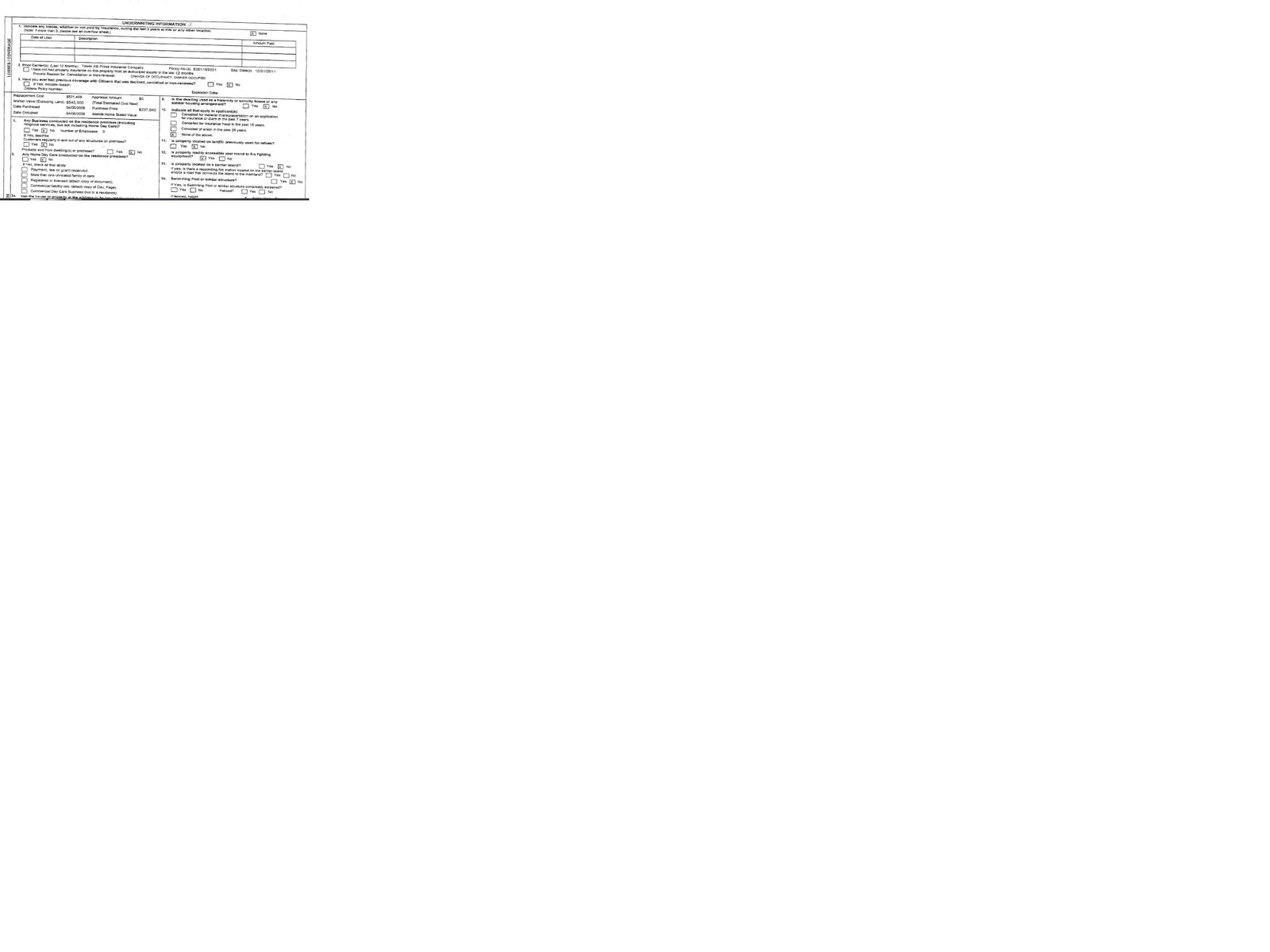

In 2013, despite our opting-out and protests, Citizens insurance company sold our policy, along with about 65,000 others, to Heritage. This was done two months after the nine-month-old company donated $110,000 to Rick Scott according to an article, “Hue and Cry Grows Over Deal for Scott Donor”, published on 5/24/2013 by the Miami Herald. A couple of days after the fire, senior claims adjuster David Kiliszek and a vice president (who has since given an affidavit denying he was there) came to our property. Their hired fire investigator came and the fire department concluded their investigation. They ruled out arson. Kiliszek gave me the sympathetic treatment. I had no idea what was to come. He convinced us not to hire a lawyer and that the claim would be paid. They gave us money to pay the first, last, and security deposit of a rental, which later we would not be able to manage and would have to move back to our property.

Before we knew it, we were walking in quicksand of poverty. They asked us to give them an interview. It was taped. My husband and I were interviewed separately. This interview was not the examination under oath, which would come later and which would be submitted to the court. They used the first interview to pry information from us, which they used to frame the questions for the examination under oath.

By March 2014, Heritage had denied our claim. They alleged that I committed fraud by “not disclosing” on the original, three year old application to Citizens that the house is on a farm and that we had prior claims. In their Motion for Summary Judgement, they said they relied on the information from the application to assume the policy. My lawyer deposed one of their top executives, Ernie Garateix, who revealed that they had not read one application. Despite that fact, they still denied my claim.

A closer look at the application revealed that it had been tampered with. It wasn’t the application that I had originally submitted. The original application I submitted had a fax header that showed 8 pages were faxed to the agent, Jorge Perez, of IPC insurance agency. The copy they provided into evidence showed that the first four pages were typed and did not have the fax header. The last four pages, which contained my signature have the fax header. The four, newly typed pages show exactly what is needed to support the insurance company’s case. Despite this and other glaring inconsistencies, Heritage filed for summary judgment, which means that the insurance company’s lawyer asked Judge Rebull to dismiss the case and not grant us a jury trial because, as a matter of law, there were no facts in dispute. He granted it.

Winning the summary judgment entitled Heritage to attorney’s fees. They claimed a little over $21,000 in the period of about five months. Although Heritage donated $110,000 to Rick Scott, they garnished $389.00 from every one of my teaching paychecks until recently when the judge granted our motion to stop under the head of household exemption. But they are not stopping at that. They have demanded that I produce three to five years’ worth of bank statements, the titles and deeds of anything I’ve owned, and an extensive list of other financial records within 15 days. They have subpoenaed my bank and tax records. As I read their demands, Ralph Ellison pops in my head, “To whom it may concern, Keep this Nigger... running!”

A wise friend warned me to be prepared in case they send the sheriff to take all my belongings and vehicles, including our trailer, to be sold by the sheriff to satisfy the judgment even while the appeal is pending.

The other allegation is that I didn’t disclose on the switched application that I ran a business (the farm). Evidence was presented to the contrary. The judge agreed with the insurance company that just because the agent knew about the farm doesn’t mean Citizens knew. According to his ruling, if IPC is not an agent of Citizens, then Citizens doesn’t know--therefore, Heritage doesn’t know either. Lastly, they argued that I didn’t disclose a prior claim on the switched application, which was disputed and our evidence presented.

As I talk to others around Homestead and Miami, and as I read Better Business complaints, I’m discovering that many hard-working homeowners are having difficulties with this company. A search of cases filed against Heritage since 2013 is shocking. According to that May 24, 2013 Miami Herald article, the current CEO of Heritage, Richard Widdicombe, used to be the CEO of People’s Trust insurance company, which was suspended and fined $150,000 by the Office of Insurance Regulators for not paying claims in a timely manner. On January 12, 2015, Heritage provided a worthless check for $12,776 as a refund of my premium, yet there is no evidence of anyone going after them.

Saturdays and Sundays are the hardest for my family. My sixteen year old is exhausted because after church, I drag them to the zoo, and when that closes, I drag them to a MacDonald’s that has a play place. She cries, “The worse thing is, we can never go home to relax.” She understands more than the little ones the precarious position of possibly coming home and finding that the sheriff hauled our home—albeit decrepit, without running water, or electricity. I try to keep them away from the hot trailer. Now that 25% of my take-home pay is being taken by Heritage, I can only run the generator which produces our electricity to run fans and to have light for 1 hour a day.

Heritage is the third biggest policy holder in Florida, waiting to amass more policies from Citizens. Is its strategy not to pay out claim so that it can leave policy holders bankrupt? If you file a claim, how will your children be affected? How about your marriage? How about your mental and emotional health? If you have Heritage, could it also force you into homelessness and bankruptcy? Hurricane season is right around the corner, if you should have a loss, what pretext will Heritage use to destroy you and not pay the claim?

I reach for my daughter’s hand and the only thing I can do is sing a verse from my favorite song that pops in my head, “His eyes is on the sparrow, and I know he watches over me.”

Who, in Tallahassee, is watching for us Floridians if a person doesn’t have $110,000 to pad a politician’s pocket? Countless hours of research reveal to me that all Floridians are a little less protected than we may think. A Division of Consumer Services Complaint Comparison on Florida’s chief Financial Officer’s website will show you how many policy your company has in relations to two other companies. It will show you how many complaints that company closed that year. However, it doesn’t show you how many complaints were filed against that company that year. Even though, I took a six month’s Insurance agent course but never had the opportunity to write a policy, I am still ignorant of the process. Despite our education, savings prior to the fire, and assets, after our house burned down, we didn’t understand how unprotected we were.